Buy Now, Pay Later services have become a major part of the UAE’s digital payment ecosystem, and Tabby is one of the most widely used platforms in this category. While many users are familiar with using Tabby online at partner stores, fewer people understand that Tabby also offers a card that can be used for in-store purchases across the UAE.

The Tabby Card allows customers to shop at physical locations and split payments into installments, without relying on traditional credit cards or paying interest. This guide explains what the Tabby Card is, how it works, who can apply, and how to receive and use it in the UAE.

What Is Tabby Card

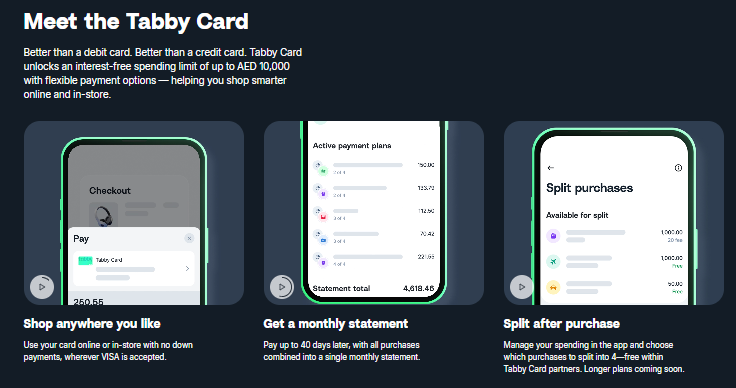

The Tabby Card is a Visa-based payment card connected directly to a user’s Tabby account. It allows shoppers to make in-store and online card payments while using Tabby’s Buy Now Pay Later system instead of paying the full amount upfront.

Unlike standard bank cards, the Tabby Card does not provide revolving credit. Each purchase is approved individually, and the payment plan is shown before the transaction is completed. This ensures that users always know how much they will pay and when each installment is due.

How the Payment System Works

When a purchase is made using the Tabby Card, the total amount is divided into four equal payments. The first portion is charged immediately, and the remaining balance is collected in scheduled installments over the following weeks. All repayment details appear in the Tabby payment app, where users can track active plans and upcoming dues.

There is no interest charged when payments are made on time. However, missed payments may result in account restrictions or service fees, and future spending limits may be reduced. This model encourages controlled spending rather than long-term borrowing.

Where the Tabby Card Can Be Used

The Tabby Card can be used at most retail locations in the UAE that accept Visa payments. It is not limited to Tabby partner stores, which makes it useful for everyday shopping, dining, and services.

Most users receive the card as a physical Visa card delivered to their address, and it can also be linked to mobile wallets for contactless payments. Acceptance depends on standard card payment terminals, just like any other Visa card used in the UAE.

Who Is Eligible for the Tabby Card

Tabby uses internal eligibility checks instead of traditional banking documents. Users do not need to submit salary certificates or bank statements. Instead, eligibility is based on verified identity and responsible usage of the platform.

To qualify, users must generally meet the following conditions:

- Be at least 18 years old

- Hold valid UAE residency and Emirates ID

- Have a verified UAE mobile number

- Maintain a positive payment history on Tabby

Approval is automated and reviewed inside the app, and access may improve as users continue to repay on time.

How to Get Tabby Card

Applying for the Tabby Card is done entirely through the official Tabby mobile application. There is no physical paperwork or branch visit required, and the entire process is digital.

Register and Verify Your Tabby Account

Users must first create an account on the Tabby app using their UAE mobile number and email address. Identity verification is required to activate payment features and usually involves submitting Emirates ID details through secure in-app verification.Only verified accounts are considered for card eligibility and installment services.

Build Eligibility Through Responsible Usage

After registration, users can shop at Tabby partner merchants and complete installment payments. Each successful transaction and on-time repayment improves the account profile and may increase spending limits.

Tabby’s system evaluates repayment behavior before unlocking additional features, including physical card access. This approach protects both merchants and users while promoting safe financial behavior.

Request the Tabby Card in the App

Once eligible, the Tabby Card option appears in the main dashboard of the app. Users can then request the card by confirming their delivery address and submitting the in-app request.

The general application process includes:

- Opening the Tabby app and selecting the Card section

- Checking eligibility status

- Confirming shipping details

- Submitting the request for processing

If the option is not visible, it means the account does not yet meet internal eligibility criteria, and continued responsible usage is recommended.

Delivery and Card Activation

After approval, the physical Tabby Card is typically delivered within several business days. Once received, users must activate it through the app by confirming the card details and setting a secure PIN for in-store payments.

After activation, the card can be used immediately at Visa-enabled terminals across the UAE, and installment plans will appear automatically inside the Tabby app after each purchase.

Managing Payments and Account Status

All repayments are handled through the Tabby app, where users can see active plans, upcoming payments, and total outstanding balances. Payments can be made using linked debit cards, credit cards, or supported digital wallets.

Maintaining timely payments is essential for keeping the card active and increasing future spending limits. Repeated missed payments may result in temporary suspension of card usage.

Conclusion

The Tabby Card offers UAE residents a flexible way to manage retail spending through interest-free installment payments, without relying on traditional credit cards. By linking directly to the Tabby app, it provides clear payment schedules, controlled spending limits, and easy tracking of financial commitments.

For users who complete identity verification and maintain positive repayment behavior, the physical Tabby Card becomes a practical payment tool for both everyday shopping and larger retail purchases across the UAE.From a business and fintech perspective, platforms like Tabby demonstrate how modern payment systems rely heavily on scalable mobile app development services to deliver secure, real-time financial experiences to millions of users. As digital payments continue to grow, seamless app-based payment infrastructure will remain at the center of consumer finance in the region.